Introduction: The Renewable Revolution in Canada

As the global transition to clean energy accelerates, Canada is positioning itself as a renewable energy powerhouse. With abundant natural resources, political stability, and increasing government support, Canada's renewable energy sector presents a compelling opportunity for investors looking toward 2025 and beyond.

This article explores why Canada's renewable energy market is experiencing unprecedented growth and how investors can capitalize on what many are calling the "Green Gold Rush."

Key Growth Drivers in Canada's Renewable Sector

Several factors are converging to create exceptional growth potential in Canada's renewable energy sector:

1. Policy Support and Incentives

The Canadian government has implemented ambitious climate targets, aiming for net-zero emissions by 2050. To achieve this goal, federal and provincial governments have introduced a range of incentives, including:

- Tax credits for clean energy investments

- Carbon pricing mechanisms that favor renewable energy

- Streamlined permitting processes for renewable projects

- Provincial renewable portfolio standards requiring utilities to source increasing amounts of power from renewable sources

2. Abundant Natural Resources

Canada possesses exceptional natural advantages for renewable energy development:

- Hydroelectric potential: Already a leader in hydropower, Canada continues to develop its vast water resources

- Wind resources: Extensive coastlines and prairies provide ideal conditions for wind energy development

- Solar potential: Despite its northern latitude, parts of Canada receive solar radiation comparable to many European countries

- Geothermal opportunities: Western provinces have significant geothermal resources that remain largely untapped

"Canada's renewable energy sector is projected to grow at a CAGR of 8.3% between 2023 and 2028, outpacing the global average of 7.1%. This represents one of the most compelling investment opportunities in North America."

— Canadian Renewable Energy Association

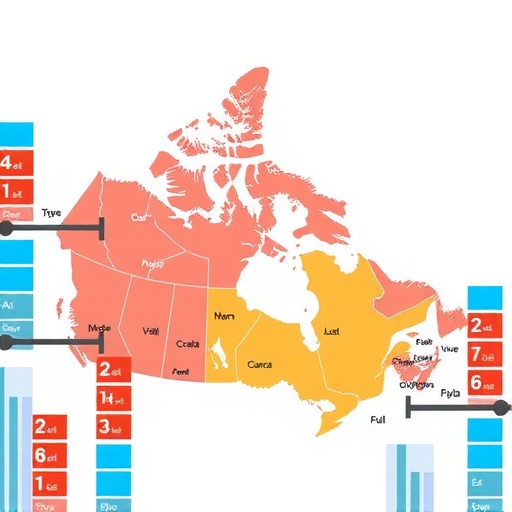

Regional Investment Hotspots

Investment opportunities vary significantly across Canadian provinces, each with distinct advantages:

British Columbia

A leader in hydroelectric power, BC is now diversifying with significant wind and solar developments. The province's commitment to clean energy and carbon pricing makes it particularly attractive for renewable investments.

Alberta

Once known primarily for oil and gas, Alberta is now experiencing a renewable renaissance. The province's abundant wind and solar resources, combined with its deregulated electricity market, create unique opportunities for investors. Alberta led Canada in new renewable energy development in 2023.

Ontario

Canada's most populous province continues to expand its renewable portfolio. Recent policy shifts have renewed focus on utility-scale solar and wind projects, creating new openings for investment as the province works to replace aging nuclear facilities.

Quebec

Leveraging its massive hydroelectric resources, Quebec is now positioning itself as a green hydrogen hub, using renewable electricity to produce hydrogen for export to the United States and Europe.

Provincial Renewable Energy Growth Projections (2025-2030)

Source: Natural Resources Canada, 2024

Emerging Subsectors with High Growth Potential

1. Energy Storage

As renewable penetration increases, energy storage solutions become critical. Canada's battery storage market is projected to grow at 27% annually through 2025, creating opportunities in:

- Grid-scale battery storage facilities

- Pumped hydro storage projects

- Innovative long-duration storage technologies

2. Green Hydrogen

Canada's abundant renewable electricity makes it ideally positioned to become a global hydrogen leader. The federal hydrogen strategy targets 30% of Canada's energy to come from hydrogen by 2050. Key investment opportunities include:

- Electrolysis facilities powered by renewable energy

- Hydrogen transportation and storage infrastructure

- End-use technologies in transportation and industry

3. Smart Grid Technologies

Canada's vast geography and increasing renewable integration create unique grid challenges. Investment opportunities in this space include:

- Advanced grid management systems

- Demand response technologies

- Microgrid solutions for remote communities

Investment Entry Points

Investors can access Canada's renewable energy market through various channels:

Public Markets

The Toronto Stock Exchange (TSX) hosts numerous renewable energy companies, from established utilities with renewable divisions to pure-play developers. Many Canadian renewable companies offer attractive dividend yields compared to global peers.

Private Equity and Venture Capital

For accredited investors, Canadian cleantech venture capital and private equity funds offer exposure to earlier-stage companies and projects with higher growth potential.

Green Bonds

Canada's green bond market has grown exponentially, with both government and corporate issuers. These fixed-income instruments provide a lower-risk way to participate in the renewable transition.

Direct Project Investment

Larger investors can participate directly in renewable energy projects, either as equity partners or through power purchase agreements (PPAs).

"The risk-adjusted returns in Canadian renewable energy projects have consistently outperformed traditional energy investments over the past five years, with the gap expected to widen further through 2025."

— Global Renewable Investment Report, 2024

Challenges and Risk Factors

While the outlook is predominantly positive, investors should be aware of several challenges:

Regulatory Uncertainty

Provincial elections can lead to policy shifts, as seen historically in Ontario and Alberta. Investors should diversify across provinces to mitigate this risk.

Grid Integration Challenges

Some regions face transmission constraints that can delay project connections. Due diligence on grid capacity is essential before committing to specific projects.

Indigenous Consultation

Projects on or near Indigenous lands require careful consultation processes. While this can extend development timelines, partnerships with Indigenous communities often lead to more successful long-term outcomes.

Climate Risk

Changing weather patterns may affect resource availability. Advanced modeling and geographical diversification can help manage these risks.

Conclusion: Strategic Positioning for 2025 and Beyond

Canada's renewable energy sector offers a compelling combination of policy support, resource abundance, and technological innovation. As global capital increasingly flows toward sustainable investments, Canada's position as a stable, resource-rich democracy makes it an ideal destination for renewable energy investment.

For investors looking to capitalize on these opportunities, the key is to act decisively while conducting thorough due diligence. The renewable transition is accelerating, and early movers will likely secure the most advantageous positions in what promises to be Canada's next great resource boom—a Green Gold Rush for the 21st century.