Introduction: Canada's Burgeoning Tech Ecosystem

While Silicon Valley has long dominated the global tech landscape, Canada has been quietly building its own formidable innovation economy. As we look toward 2025, the Canadian tech ecosystem is reaching a critical inflection point, transforming from a collection of promising startups to a mature network of innovation hubs that are attracting global talent and investment capital.

This evolution presents significant opportunities for investors who understand the unique characteristics of Canada's regional tech centers and the sectors where Canadian innovation is leading globally.

The Major Tech Hubs: Traditional Powerhouses

1. Toronto-Waterloo Corridor

Often called "Silicon Valley North," the Toronto-Waterloo corridor has emerged as Canada's premier tech ecosystem and one of North America's fastest-growing innovation hubs. Spanning approximately 112 kilometers, this region hosts:

- Over 15,000 tech companies

- Canada's highest concentration of AI startups

- Major research institutions including the University of Toronto and University of Waterloo

- Canadian headquarters for tech giants like Google, Microsoft, and Amazon

Investment Focus: The corridor excels in AI, fintech, health tech, and enterprise software. Notably, the region's AI startups have attracted substantial funding, with companies like Layer 6 (acquired by TD Bank) and Deep Genomics demonstrating the commercial potential of Canadian AI research.

"The Toronto-Waterloo corridor is now attracting more venture capital per capita than any U.S. region outside of San Francisco and New York. The integration of world-class research, entrepreneurial talent, and supportive government policies has created a uniquely Canadian formula for tech success."

— Canadian Venture Capital Association

2. Vancouver

Vancouver's proximity to Seattle and Silicon Valley, combined with its exceptional quality of life, has made it a magnet for tech talent and companies seeking a Canadian base:

- A thriving visual effects, gaming, and digital media cluster

- Growing presence in cleantech and sustainable technologies

- Home to successful tech companies like Hootsuite and Slack (before its acquisition)

- Strong connections to Asian markets and investment

Investment Focus: Vancouver excels in digital entertainment, AR/VR technologies, and increasingly in cleantech and quantum computing. The city's climate action plan has spurred innovation in green technologies, creating investment opportunities aligned with global sustainability trends.

3. Montreal

Montreal has established itself as a global leader in AI research and deep tech:

- Home to MILA, one of the world's largest deep learning research institutes

- Major AI research labs from Facebook, Google, Microsoft, and Samsung

- Vibrant video game development scene

- Strong aerospace and life sciences sectors integrating with digital technologies

Investment Focus: Montreal's unique strength lies at the intersection of AI and specialized domains like healthcare, creative industries, and industrial applications. The city's bilingual nature also makes it a gateway for European tech companies entering North American markets.

Emerging Innovation Centers: The New Frontier

1. Calgary

Once dominated by oil and gas, Calgary is rapidly reinventing itself as a tech hub focused on energy transition and industrial innovation:

- Energy transition technologies and cleantech

- Agtech innovations supporting Canada's agricultural sector

- Industrial IoT and smart infrastructure

- Significant municipal and provincial funding for tech diversification

Investment Focus: Calgary offers unique opportunities in technologies that leverage the region's energy expertise while enabling transition to sustainable models. The Platform Calgary Innovation Centre and the city's $100 million Opportunity Calgary Investment Fund represent significant commitments to this transformation.

2. Ottawa

Canada's capital has a long history in telecommunications (as the original home of Nortel) and is now experiencing a renaissance:

- Strong focus on cybersecurity and defense tech

- Growing SaaS cluster led by companies like Shopify

- Close ties to government technology needs and procurement

- Exceptional engineering talent from local institutions

Investment Focus: Ottawa offers compelling opportunities in B2B software, cybersecurity, and govtech. The city's lower cost of living compared to Toronto and proximity to government clients create advantages for startups in regulated industries.

3. Halifax and Atlantic Canada

The Atlantic provinces are emerging as unexpected tech hotspots:

- Ocean technology and blue economy innovations

- Digital health solutions

- Growing fintech presence

- Government incentives for tech development

Investment Focus: Atlantic Canada offers specialized opportunities in ocean tech, rural innovation, and digital health. The region's universities produce excellent technical talent, while the lower cost base allows startups to achieve longer runways with their funding.

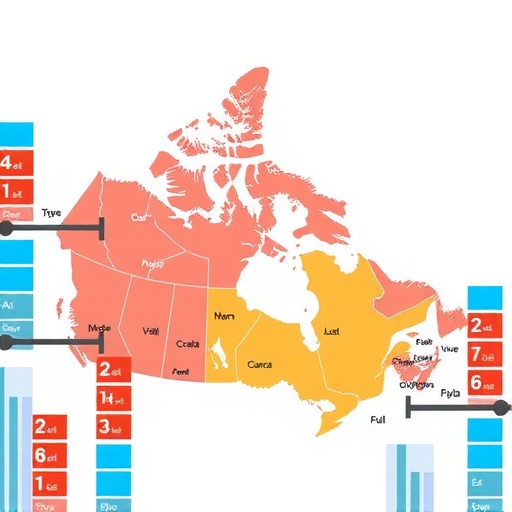

Canadian Tech Hub Comparison (2023-2024)

Source: Canadian Venture Capital & Private Equity Association, 2024

Sector-Specific Opportunities Across Regions

1. Artificial Intelligence and Machine Learning

Canada's early investment in AI research is paying dividends as companies commercialize these technologies:

- Toronto: Applied AI in finance, retail, and enterprise

- Montreal: Deep learning research and creative AI applications

- Edmonton: Reinforcement learning and AI for complex systems

The Canadian AI ecosystem is maturing beyond research, with enterprise adoption accelerating and specialized applications emerging in regulated industries where Canada's stable governance provides advantages.

2. Cleantech and Climate Solutions

Canada's commitment to emissions reduction is driving innovation across the country:

- Vancouver and Calgary: Leading in cleantech innovation related to energy transition

- Toronto: Focusing on green building technologies and smart city solutions

- Montreal: Developing clean transportation and industrial efficiency technologies

The federal government's Net Zero Accelerator initiative, with $8 billion in funding, is further catalyzing investment in this sector, making it one of the most promising areas for tech investment in Canada through 2025.

3. Digital Health and Biotechnology

The pandemic accelerated digital health adoption, building on Canada's strong life sciences foundation:

- Toronto: Home to MaRS Discovery District's health innovation ecosystem

- Montreal: Leading in AI-driven drug discovery and biotech

- Vancouver: Focusing on precision medicine and genomics

Canada's universal healthcare system provides unique advantages for health tech companies, including access to comprehensive data and a clearly defined path to institutional adoption.

4. Quantum Computing

Canada is positioning itself as a global leader in quantum technologies:

- Waterloo: Home to the Institute for Quantum Computing and quantum startups like Xanadu

- Vancouver: D-Wave Systems, a pioneer in quantum annealing technology

- Toronto and Montreal: Growing quantum software ecosystems

The National Quantum Strategy, with $360 million in federal funding, aims to amplify Canada's quantum advantage. Early-stage investment opportunities exist in both hardware and quantum software applications.

Investment Entry Points

Venture Capital

Canada's VC ecosystem has matured significantly:

- Established firms like Georgian, Inovia Capital, and OMERS Ventures offer access to later-stage Canadian tech

- Specialized funds focusing on specific sectors like AI (Real Ventures) or cleantech (ArcTern Ventures)

- Growing presence of international VCs with Canadian offices or dedicated Canadian investment theses

Public Markets

The Toronto Stock Exchange (TSX) and TSX Venture Exchange host numerous tech companies:

- Established players like Shopify, Constellation Software, and Lightspeed

- Emerging growth companies accessing public markets at earlier stages than their U.S. counterparts

- Specialized ETFs providing exposure to Canadian innovation sectors

Corporate Innovation Partnerships

For strategic investors, Canadian tech hubs offer partnership opportunities:

- Corporate innovation labs and accelerators in major centers

- Research partnerships with leading institutions

- Government matching programs that amplify corporate investment

The Canadian Advantage: Key Differentiators

Immigration Policies

Canada's tech-friendly immigration policies have become a significant competitive advantage:

- The Global Talent Stream allows companies to bring in key technical talent in as little as two weeks

- Start-up Visa Program attracts international entrepreneurs

- Growing international student population creates a pipeline of qualified tech workers

These policies have become even more valuable amid global competition for tech talent and immigration restrictions in other markets.

Government Support

Federal and provincial governments provide substantial support for tech development:

- Scientific Research and Experimental Development (SR&ED) tax incentives

- Strategic Innovation Fund for larger projects

- Specialized programs like the AI Strategy and the Pan-Canadian Quantum Initiative

These programs reduce investment risk and extend startup runways, creating more opportunities for successful commercialization.

Cost Advantages

Despite recent increases, operating costs in Canadian tech hubs remain competitive:

- Tech salaries typically 20-30% lower than comparable U.S. hubs

- Universal healthcare reduces employer benefit costs

- Government incentives further reduce effective operating expenses

These factors create longer runways for startups and better unit economics for scaling companies.

Challenges and Considerations

Scale-up Funding

While early-stage funding has improved dramatically, Canada still faces challenges in late-stage growth capital:

- Series B and beyond funding rounds often require U.S. investor participation

- Limited number of domestic investors who can lead $50M+ rounds

- Brain drain risk when companies need to relocate for funding

However, this gap is narrowing as Canadian success stories create experienced founders and operators who reinvest in the ecosystem.

Talent Competition

Despite favorable immigration policies, competition for specialized tech talent remains intense:

- Growing remote work opportunities from U.S. employers

- Salary pressure in high-demand areas like AI and cybersecurity

- Retention challenges for scaling companies

Companies with strong cultures, meaningful missions, and equity upside are best positioned to attract and retain top talent.

Commercialization Speed

Canadian startups have historically faced challenges in aggressive commercialization:

- More conservative corporate procurement processes

- Smaller domestic market requiring earlier international expansion

- Cultural preference for sustainable growth over "blitzscaling"

However, this is changing as more experienced founders and international investors bring global growth mindsets to Canadian ventures.

Conclusion: Strategic Positioning for 2025

Canada's tech ecosystem has reached a maturity inflection point that creates compelling investment opportunities across multiple regions and sectors. The country's combination of world-class research, supportive policies, cost advantages, and growing success stories has created a uniquely favorable environment for technology development.

For investors looking to capitalize on Canadian innovation, the key is understanding the distinct advantages of each regional hub and the sectors where Canadian companies have built sustainable competitive advantages. While challenges remain in scaling and commercialization, the ecosystem's rapid evolution suggests that 2025 will see more Canadian tech companies achieving global leadership positions in their categories.

The most promising opportunities lie at the intersection of Canada's traditional strengths (resources, finance, healthcare) and transformative technologies (AI, quantum, cleantech). By focusing on these convergence points, investors can benefit from Canada's emergence as a global innovation leader while managing the risks inherent in technology investment.