Introduction: The Transformed Healthcare Landscape

The COVID-19 pandemic has fundamentally reshaped Canada's healthcare ecosystem, accelerating digital transformation and exposing critical infrastructure gaps that require substantial investment. As we look toward 2025, these changes are creating unprecedented opportunities for investors across multiple healthcare subsectors.

This article examines how the convergence of policy shifts, technological innovation, and demographic trends is creating a favorable investment environment in Canada's healthcare sector, with specific focus on the most promising opportunities.

The Pandemic's Lasting Impact on Healthcare Investment

Policy and Funding Shifts

The pandemic prompted significant government policy responses that continue to shape the investment landscape:

- Increased federal healthcare transfers to provinces, with $196 billion committed over the next decade

- Targeted funding for healthcare infrastructure modernization

- Regulatory changes enabling faster adoption of digital health technologies

- Enhanced focus on domestic medical supply chain resilience

These policy shifts have created a more supportive environment for healthcare innovation and investment, particularly in areas that address system resilience and modernization.

Accelerated Digital Transformation

The pandemic compressed years of digital adoption into months, particularly in telehealth and remote care models. Pre-pandemic, less than 20% of Canadian physician visits were conducted virtually; at the height of lockdowns, this surged to over 70%. While usage has moderated, virtual care remains significantly above pre-pandemic levels, creating enduring market opportunities.

Supply Chain Restructuring

Supply chain vulnerabilities exposed during the pandemic have led to investments in domestic production capacity for critical medical supplies, pharmaceuticals, and vaccines. The federal government's Biomanufacturing and Life Sciences Strategy, with $2.2 billion in funding, represents a significant commitment to building domestic capabilities.

"We're witnessing a once-in-a-generation restructuring of Canada's healthcare system. The pandemic has created both political will and capital flows to address longstanding challenges, opening substantial investment opportunities across the healthcare value chain."

— Canadian Healthcare Infrastructure Investment Council

Key Investment Opportunities by Subsector

1. Digital Health and Telehealth

The digital health sector is experiencing unprecedented growth, with several compelling investment themes:

- Telehealth platforms: Companies providing comprehensive virtual care solutions that integrate with existing healthcare systems

- Remote monitoring: Technologies enabling continuous monitoring of chronic conditions outside clinical settings

- Mental health tech: Digital therapeutics and virtual care platforms addressing the growing mental health crisis

- Healthcare AI: Artificial intelligence applications for diagnostics, administrative efficiency, and personalized care

The Canadian market for digital health solutions is projected to grow at a CAGR of 28% through 2025, reaching $5.5 billion annually. Particularly promising are solutions that address Canada's geographic challenges in delivering care to remote communities.

2. Biopharmaceuticals and Life Sciences

Canada's renewed focus on domestic biopharmaceutical capabilities is creating opportunities in:

- Vaccine development and manufacturing: Facilities and technologies supporting vaccine self-sufficiency

- Advanced therapeutics: Cell and gene therapies, with Canada becoming a leader in research

- Precision medicine: Diagnostics and treatments targeting specific genetic profiles

- Contract development and manufacturing: Services supporting the pharmaceutical value chain

Investment in this subsector is supported by government incentives, world-class research institutions like the University of Toronto and McGill University, and growing venture capital interest. The Montreal-Toronto corridor, in particular, is emerging as a globally significant biotech hub.

3. Senior Care and Aging-in-Place Technology

Canada's aging demographic creates substantial investment opportunities in senior care:

- Senior housing: Purpose-built communities with integrated healthcare services

- Home care technology: Solutions enabling seniors to remain in their homes longer

- Assistive technologies: Devices and software improving independence and quality of life

- Care coordination platforms: Systems connecting formal and informal caregivers

With Canadians over 65 projected to represent 23% of the population by 2030, this sector offers long-term growth potential backed by demographic certainty. The pandemic has particularly accelerated interest in alternatives to traditional long-term care facilities.

4. Healthcare Infrastructure

Physical healthcare infrastructure represents a significant investment opportunity:

- Hospital modernization: Upgrading aging facilities to meet current standards and pandemic resilience

- Ambulatory care centers: Purpose-built facilities for outpatient procedures

- Diagnostic centers: Facilities addressing diagnostic backlogs created during the pandemic

- Public-private partnerships: Innovative financing models for healthcare infrastructure

With much of Canada's healthcare infrastructure built in the 1960s and 1970s, substantial renewal investments are required. The federal government has committed $4 billion specifically for healthcare infrastructure over the next five years.

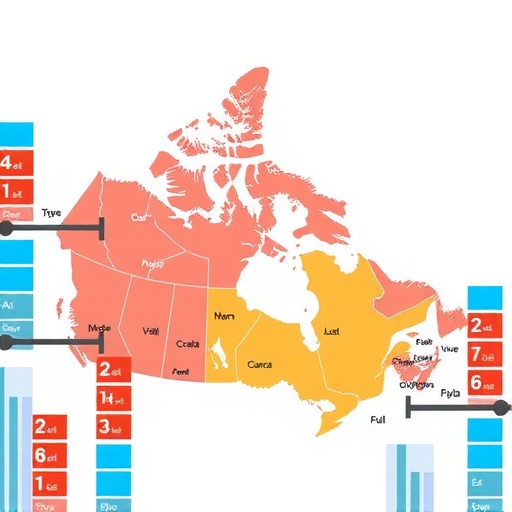

Canadian Healthcare Investment Growth by Subsector (2022-2025)

Source: Canada Health Investment Monitor, 2024

Regional Investment Hotspots

Ontario

Ontario offers a concentration of healthcare innovation, particularly in Toronto:

- MaRS Discovery District, home to numerous health tech startups

- University Health Network, Canada's largest research hospital

- Substantial government support through the Ontario Life Sciences Strategy

Investment focus: Digital health, biotech, and medical devices, with strong university-industry collaboration models.

Quebec

Quebec has established strengths in pharmaceutical research and manufacturing:

- Greater Montreal's pharmaceutical cluster with over 150 companies

- Medicago's plant-based vaccine production facility

- McGill University and Université de Montréal research excellence

Investment focus: Biologics manufacturing, pharmaceutical research, and AI applications in healthcare.

British Columbia

British Columbia is emerging as a digital health leader:

- Digital Supercluster with healthcare technology focus

- Strong provincial support for virtual care initiatives

- Growing cluster of telehealth and remote monitoring companies

Investment focus: Telehealth, mental health tech, and health data platforms leveraging the province's tech ecosystem.

Alberta

Alberta is leveraging its energy expertise to diversify into healthcare:

- Calgary Cancer Centre, a $1.4 billion research and treatment facility

- Growing medtech manufacturing sector

- Provincial incentives to attract healthcare investment

Investment focus: Medical devices, health data infrastructure, and specialized care facilities.

Investment Entry Points

Public Markets

The Toronto Stock Exchange (TSX) offers exposure to established healthcare companies:

- Pharmaceutical manufacturers like Bausch Health Companies

- Healthcare services providers such as CareRx Corporation

- Medical device companies including Profound Medical

- Healthcare REITs focused on medical facilities and senior housing

While Canada's public healthcare markets are smaller than those in the U.S., they often offer better valuations and access to companies with stable revenue streams from the Canadian healthcare system.

Private Equity and Venture Capital

For accredited investors, private market opportunities include:

- Specialized healthcare VC funds like Lumira Ventures and CTI Life Sciences

- Healthcare-focused private equity funds targeting middle-market opportunities

- Direct investment in growth-stage healthcare companies

- Limited partnerships in healthcare infrastructure projects

Canadian healthcare startups raised a record $952 million in 2023, representing a 37% increase over pre-pandemic levels. Early-stage valuations remain attractive compared to U.S. counterparts.

Real Estate and Infrastructure

Physical healthcare assets offer stable, long-term returns:

- Purpose-built medical office buildings

- Senior living communities and long-term care facilities

- Specialized healthcare facilities like ambulatory surgical centers

- Infrastructure funds with healthcare allocations

These investments typically offer lower volatility and potential income streams, making them attractive for investors seeking portfolio stability with exposure to healthcare growth.

ETFs and Mutual Funds

For retail investors, several funds provide diversified exposure to Canadian healthcare:

- CI Healthcare Leaders ETF

- Harvest Healthcare Leaders Income ETF

- TD Health Sciences Fund

These vehicles offer broader exposure across the healthcare ecosystem while mitigating single-company risk.

Navigating Canadian Healthcare Investment Challenges

Regulatory Considerations

Canada's healthcare regulatory environment presents unique challenges:

- Provincial jurisdiction over healthcare delivery creating regulatory fragmentation

- Health Canada approval processes for new therapies and technologies

- Privacy regulations governing health data usage

- Reimbursement policies affecting commercial viability

Successful investors must understand these regulatory dynamics and how they affect investment timelines and commercialization strategies.

Public-Private Integration

Canada's publicly funded healthcare system creates both opportunities and challenges:

- Navigating procurement processes for public healthcare contracts

- Understanding provincial funding models and budgetary constraints

- Identifying appropriate public-private partnership structures

- Managing public perception around private investment in healthcare

The most successful companies develop models that complement rather than compete with public healthcare provision, addressing system gaps while maintaining alignment with Canadian healthcare values.

Talent Acquisition and Retention

Healthcare innovation requires specialized talent:

- Competition with U.S. employers offering higher compensation

- Need for cross-disciplinary teams combining healthcare and technology expertise

- Regulatory expertise specific to Canadian healthcare markets

Companies with strong talent strategies, including partnerships with Canadian academic institutions and remote work policies leveraging Canada's quality of life advantages, are better positioned for success.

Risk Factors to Consider

Political and Policy Risk

Healthcare is inherently political in Canada:

- Provincial election cycles potentially affecting healthcare priorities

- Evolving federal-provincial healthcare funding agreements

- Public sentiment regarding private sector involvement in healthcare

Investments with multiple provincial markets or diversified revenue streams help mitigate these risks.

Adoption Timelines

Healthcare innovation often faces adoption challenges:

- Conservative clinical adoption practices

- Evidence requirements for new technologies

- Integration complexity with existing systems

Realistic timelines and capital strategies accounting for longer adoption cycles are essential for success.

Cross-Border Competition

Canadian healthcare companies face competition from larger U.S. counterparts:

- Scale advantages of U.S. healthcare enterprises

- Capital access disparities

- Talent recruitment challenges

The most successful Canadian healthcare investments typically focus on unique value propositions tailored to the Canadian market or leverage Canada's research excellence in targeted areas.

Conclusion: Strategic Positioning for 2025

Canada's healthcare sector presents compelling investment opportunities as we approach 2025, driven by the lasting impacts of the pandemic, demographic trends, and technological innovation. The combination of increased public funding, regulatory evolution, and system transformation creates a uniquely favorable environment for strategic healthcare investments.

For investors seeking exposure to this sector, the key is identifying opportunities that address critical healthcare system needs while navigating the complexities of Canada's public-private healthcare ecosystem. Companies and solutions that enhance system efficiency, improve care access, strengthen domestic capabilities, or address the needs of an aging population are particularly well-positioned.

While challenges exist, including regulatory complexity and adoption timelines, Canada's stable healthcare funding environment and commitment to system modernization create a foundation for sustainable growth. By understanding regional strengths, policy dynamics, and healthcare system needs, investors can identify opportunities that deliver both financial returns and positive healthcare system impact as Canada rebuilds and transforms its healthcare infrastructure for the post-pandemic era.